idaho estate tax return

Check your Idaho State Refund Status click here. You can apply online for this number.

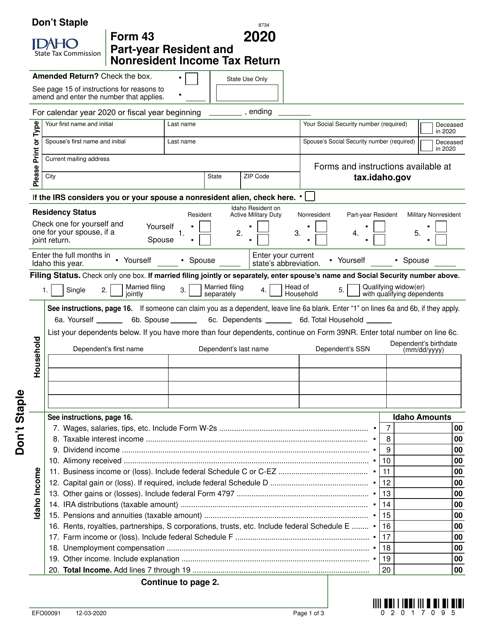

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho has no state-level estate tax.

. Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries. Idaho has no gift tax and it is the most efficient and straightforward tool to reduce the taxable part of your estate. 13 April 2013 Author.

Messages left on the estate tax lines will be monitored and callers will receive a response as soon as possible. Treasure Valley Concerned Over Rise in IRS Estate Tax Audits. Idaho state income tax rates range from 0 to 65.

Its one of the following whichever is greater. State tax commission offices in Coeur dAlene and Lewiston are open on Monday. The decedent and their estate are separate taxable entities.

Understand typical refund time frames. The goal of this post will be to discuss certain Idaho estate gift and inheritance tax issues to get you up to speed. It takes about 3 weeks to enter a first-time filer into our system.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29.

For paper filing it can take up to 10 weeks for your refund to complete processing. Idaho has no state inheritance or estate tax. Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32.

This article goes over topics that include probate how to successfully create a valid will in Idaho and what happens to your property if you die without a. Include Form PTE-12 with the return if the trust or estate files as a pass-through entity. Direct Deposit is not available for Idaho.

Thats also the date by which Idaho residents must file their state tax returns. So make sure you review your situation with a qualified CPA or tax professional. Idaho Estate and Transfer Tax Return must immediately be filed along with a copy of the amended Federal Estate Tax Return.

Form 65 Partnership Return of Income and Instructions 2021 approved. 7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last. All Major Categories Covered.

Before filing Form 1041 you will need to obtain a tax ID number for the estate. The deadline to file your federal tax returns has been pushed back to Monday this year. 500 South Second Street.

A fiduciary must file Form 66 Idaho Fiduciary Income Tax Return when any of the following circumstances apply. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. You can expect your refund about 10 to 11 weeks after we receive your return.

As such the amount you receive can be spent or saved in any way you see fit. If they owe taxes they can go online to our website to pay with our free quick pay service. Sarah FisherMar 03 2020.

Business name State use only Federal Employer Identification Number EIN Current business mailing address City State ZIP code NAICS Code. Letter to IRS requesting prompt audit of estate tax return 347 31. The amount is based on the most recent approved 2019 tax return information on file at the time the rebate is issued.

Idaho State Tax Commission PO Box 56 Boise ID 83756-0056. Theres also no estate tax levied on a state basis in Idaho though you will be required to pay federal taxes on the estate in some instances which will be discussed further in the following. The Idaho tax filing and tax payment deadline is April 18 2022.

Written notice of any changes in the federal estate tax liability must be submitted to the Idaho State Tax Commission along. This number doubles for a married couple and becomes 2412 million. E-Filing non-resident ID state returns is not available.

50 per taxpayer and each dependent. Include a complete copy of your federal Form. We must manually enter information from paper returns into our database.

A return shall be required to be filed with the Commission by every estate that is required by the laws of the United States to file a federal estate tax return. 9 of the tax amount reported on Form 40 line 20 or line 42 for eligible Idaho residents and service members using Form 43. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. Non-resident ID state returns are available upon request. Idaho does not impose or assess an estate tax even though the federal government does.

Estate planning can be complex. Estate Taxes Only Affect Wealthiest Estates. Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30.

E-File is not available for Idaho. If you have questions about either the estate tax or inheritance tax call 517 636-4486. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

Payment of any additional tax due together with any applicable interest and penalty must accompany the Idaho return. Enter the total of Idaho distributable income from Form PTE-12 columns b c and e. Idaho State Income Taxes for Tax Year 2021 January 1 - Dec.

And although the Federal Gift Tax applies. This requirement extends to nonresident estates which have property interests with situs within Idaho included in the federal estate gross value. The final Idaho return for the trust or estate.

Continue to page 2. Select Popular Legal Forms Packages of Any Category. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

Gifting away shares of your property to heirs presumptive you can protect up to 1206 million worth of heirdom. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a ID state return. For first-time filers if you have received the message that your return is not in our system please be patient.

Find IRS or Federal Tax Return deadline details. Preparation of a state tax return for Idaho is available for 2995. TAX RETURNS--DATE TO BE FILED--EXTENSIONS.

Idaho Estate Tax Everything You Need To Know Smartasset

Fly With The Eagles Sweeping Views From This Architectural Opulent Estate Architect Bill Schroeder Crea Fountain Hills Fountain Hills Arizona Unique Buildings

Irs Tax Liability Upon Death If Married And Filing Separately

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

Idaho Estate Tax Everything You Need To Know Smartasset

How To File Taxes For Free In 2022 Money

Incredible Waterfront Lodge For 20 On Lake Coeur D Alene Kootenai County Coeur D Alene Lake Cabins Cabin Rentals

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Greystone Park Mansion 905 Loma Vista Drive Beverly Hills California Usa Mansions House Design Beverly Hills

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Where S My State Refund Track Your Refund In Every State

Idaho Estate Tax Everything You Need To Know Smartasset

Will The Irs Extend The Tax Deadline In 2022 Marca

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Tax Form Templates 5 Free Examples Fill Customize Download

Filing An Idaho State Tax Return Things To Know Credit Karma

Here S The Average Irs Tax Refund Amount By State Gobankingrates